This is a high-level quantitative finance short course. You’ll develop your knowledge of the most widely used models in the banking industry, particularly in relation to the interest rate and FX markets.

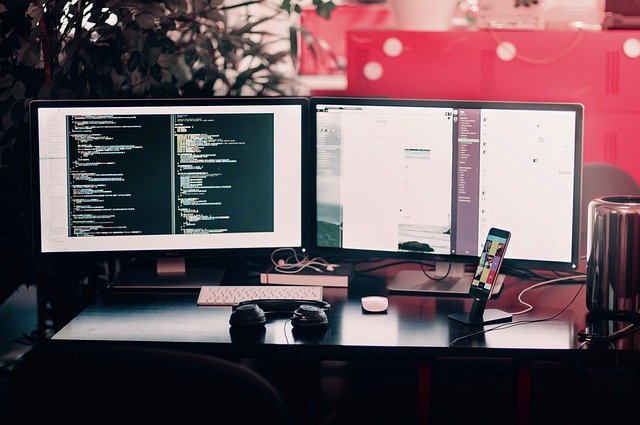

Learn from a highly experienced banking practitioner to prepare for the next steps in your finance career. You’ll also develop your knowledge of the C++ programming language.

You’ll learn the most important concepts in financial engineering from an expert with over 12 years of experience in the banking industry. A solid grounding in quantitative finance and the ability to use C++ will allow you to take the next steps in your banking career.

The course is taught once a week on weekday evenings, allowing you to fit your learning in around other commitments.

Who is it for?

You’ll need some knowledge of financial engineering to join this course. Strong mathematical skills are a must. It’s the ideal way into roles such as quantitative analyst, market risk manager or market risk model methodology manager.

Find out more about our Computer science and computing at City, University of London courses

Timetable

This course takes place for two hours every Wednesday evening for 10 weeks.

City Short Courses follow the academic year, delivering courses over three terms. These include:

- Autumn – October

- Spring – January

- Summer – April

Benefits

- Taught by an industry professional

- Access to online materials

- Awarded a City, University of London certificate